If you’re planning to sell a house, a flat, a plot of land, or any immovable property — the Income Tax department has a surprise for you. The Finance (No. 2) Act, 2024 has changed the way long-term capital gains (LTCG) on property sales are taxed.

Section 112 of the Income Tax Act holds the rules for long-term capital gains on selling land, buildings, or both – simply taxation on sale of immovable property, and trust me, it’s a maze.

And here’s the twist: Section 112 only talks about long-term gains. If your property sale counts as short-term (owned for 24 months or less), the gain is simply added to your total income and taxed at your normal slab rate. That’s a separate story of Taxation on Sale of Immovable Property, so we’re not diving into it here.

This blog is to take the heavy legal wording, remove the tax-jargon dust, and give you a clear, simple guide to how taxation on sale of immovable property are calculated – after the recent changes.

Immovable property for income tax purposes means:

- Land

- Building

- Or both together (like a house with its plot)

Now, the age of the property in your hands decides whether your gain is long-term or short-term.

- Long-Term Capital Asset (LTCG): Property held more than 24 months before you sell it.

- Short-Term Capital Asset (STCG): Property held 24 months or less before sale.

Why does this matter?

Because Section 112 — the one we’re decoding here — only deals with long-term capital gains.

Short-term gains from sale or transfer of immovable property, don’t get a “special” tax rate. They just join your other income and are taxed at your normal slab.

If you’re thinking, “But I don’t want to remember all these months, rules, and dates…” — that’s exactly why we built the Capital Gain Calculator. You enter your purchase and sale details, and it instantly tells you whether it’s long-term or short-term, plus the exact tax payable.

Taxation on Sale of Immovable Property

The tax rate you pay on selling a long-term property depends on when you sell it and who you are.

Here’s the post–Finance (No. 2) Act, 2024 snapshot:

| Assessee Type | Sale Before 23 July 2024 | Sale On/After 23 July 2024 |

|---|---|---|

| Resident Individual / HUF | 20% | 12.5% |

| Domestic Company | 20% | 12.5% |

| Partnership Firm / LLP / AOP / Trust (Resident) | 20% | 12.5% |

| Non-Resident (Individual or other) | 20% | 12.5% |

| Foreign Company | 20% | 12.5% |

The Good news is the indexation benefit under Section 48 still applies — you can adjust your purchase price for inflation before calculating gains.

But wait There’s a special relief provision if you bought the property before 23 July 2024. Sounds great, right? Well… it may not be available to everyone. To know if you’re on the “relief list” or the “sorry, not for you” list – keep reading.

And yes, the Capital Gain Calculator we have built figures this out for you instantly — no guesswork.

The Special Relief: Who Gets It and Who Doesn’t

When the tax rate on long-term property gains dropped from 20% to 12.5% (for sales on or after 23 July 2024), most people assumed: “Lower rate? Great for everyone!”

But the law had a tiny footnote — actually, a second proviso to Section 112(1)(a) — that quietly limited who gets a safety net.

Here’s what it says in simple language:

If you’re a resident individual or HUF and you sell a long-term property (land, building, or both) bought before 23 July 2024, and if the new 12.5% rate ends up making you pay more than the old 20% rate (due to indexation, exemptions, or other quirks), you don’t have to pay that extra amount.

In other words:

- You pay the lower of the old method of tax calculation or the new method of tax calculation.

- But this protection is only for resident individuals and HUFs.

- no other assessee will get this relief like Partnership Firm, Company (Domestic or Foreign doesn’t matter)

- For them, the 12.5% rate applies straight up from 23 July 2024 — no “what’s cheaper” comparison.

Pro Tip:

This is exactly where many people get it wrong. They see “12.5%” and think “less tax,” but in some cases, especially with high-indexation assets, the 20% old rule could actually produce less tax. That’s why our Capital Gain Calculator checks both scenarios automatically — and tells you the cheaper option if you’re eligible for the relief.

Indexation: Your Inflation Shield

In simple words:

Indexation adjusts your property’s purchase price for inflation. This means that when you sell, your “cost” isn’t what you actually paid years ago – it’s a higher, inflation-adjusted cost, which reduces your taxable gain.

How it works

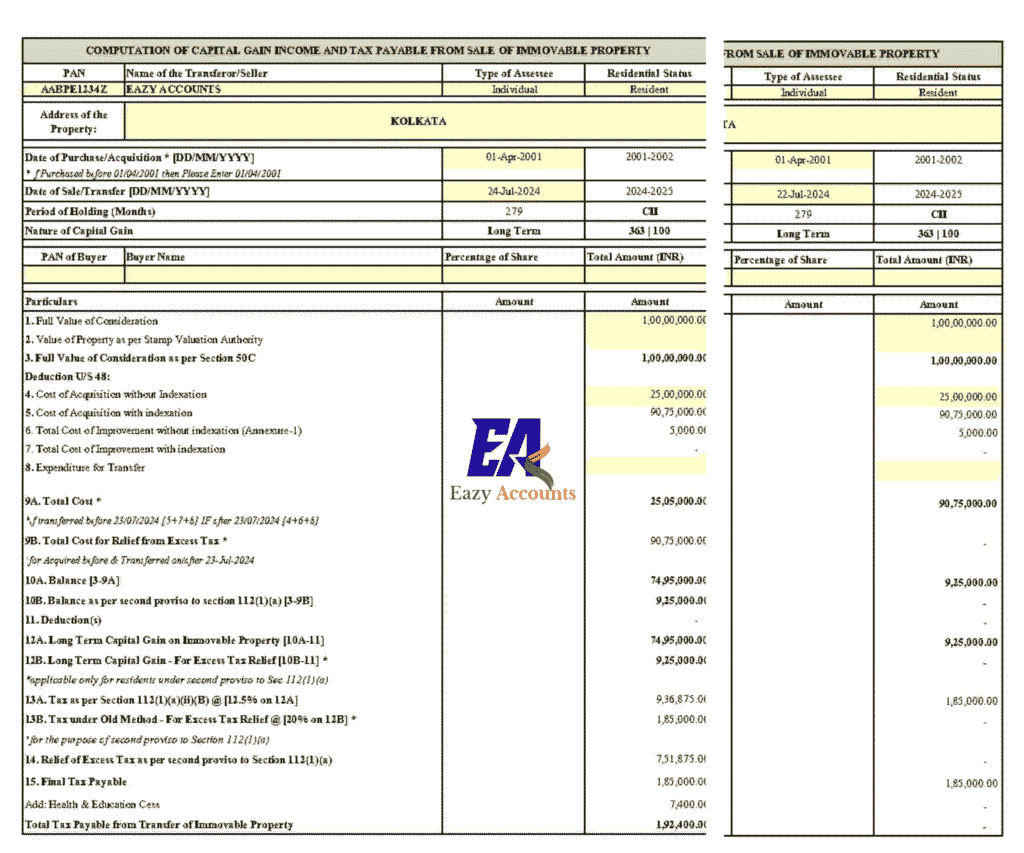

The tax department publishes a Cost Inflation Index (CII) every year.

Formula for indexed cost is:

Indexed Cost of Acquisition = (Purchase Price × CII in Year of Sale) ÷ CII in Year of PurchaseExample:

- Bought a plot in FY 2012–13 for ₹20,00,000 (CII = 200)

- Sold it in FY 2025–26 for ₹60,00,000 (CII = 363)

- Indexed Cost = ₹20,00,000 × (363 ÷ 200) = ₹36,30,000

- LTCG = ₹60,00,000 – ₹36,30,000 = ₹23,70,000

- Tax = 20% or 12.5% depending on sale date & relief eligibility

Why it matters with the new 12.5% rate

Some people think: “Lower rate = no need for indexation.” Wrong.

In certain cases, 20% with indexation can still work out to less tax than 12.5% without — especially if you bought the property long ago.

The extra relief of paying the lower of the two (old 20% vs new 12.5%) is only for resident individuals and HUFs who bought the property before 23 July 2024.

Others don’t get this safeguard — but indexation itself is still available to everyone for all long-term property sales if its acquired before 23/07/2024.

That’s why our Capital Gain Calculator always applies indexation correctly and even compares both regimes for eligible sellers — no manual math, no confusion.

How to Reduce Your LTCG Tax: Deductions & Exemptions

Just because you’ve made a long-term capital gain doesn’t mean you have to hand over a chunk of it to the taxman without a fight (a legal fight, of course). The Income Tax Act gives you a few perfectly valid escape routes — provided you meet the conditions.

Here are the most common exemptions:

1. Section 54 – Buy Another Residential House

- Applies when you sell a residential house property and buy/construct another residential house in India.

- Time limits:

- Purchase: within 1 year before or 2 years after sale

- Construction: within 3 years after sale

- You can claim exemption up to the amount you invest.

- If you sell the new house within 3 years, the exemption is reversed.

2. Section 54F – Invest in a Residential House (Any Asset Sold)

- Applies when you sell any long-term asset (including land/building) and invest the entire net sale consideration in a residential house.

- Key catch: You shouldn’t already own more than one residential house on the date of transfer (apart from the new one).

3. Section 54EC – Capital Gain Bonds

- Invest your gains in NHAI / REC / specified bonds within 6 months of sale.

- Maximum investment limit: ₹50 lakh.

- Lock-in: 5 years.

- Exemption is up to the amount invested in these bonds.

4. Capital Gains Account Scheme (CGAS)

- If you can’t invest before the due date of filing your ITR, park the unutilised amount in a Capital Gains Account in a bank, and use it later for your investment within the allowed time.

These exemptions reduce your taxable capital gain, which is then taxed at 20% or 12.5%, depending on sale date and eligibility for relief.

Short-Term vs Long-Term: A Quick Comparison

Even though this blog is focused on long-term capital gains (LTCG) under Section 112, it’s good to see how it stacks up against short-term capital gains (STCG) on property.

| Feature | Short-Term (≤ 24 months) | Long-Term (> 24 months) |

|---|---|---|

| Tax Rate | Normal slab rates (0% to 30% + cess) | 20% (before 23 Jul 2024) or 12.5% (on/after 23 Jul 2024) |

| Indexation | Not allowed | Allowed |

| Relevant Section | Section 48 + Slab rules | Section 48 + Section 112 |

| Exemptions (54, 54F, 54EC) | Not available | Available |

| Relief Provision | Not applicable | Only for resident individuals/HUFs (second proviso) |

| Capital Gain Calculator Coverage | Yes | Yes |

Key takeaway:

Short-term gains on property can be brutally taxed if you’re in the higher slabs, because there’s no indexation or special rate. That’s why holding period planning is crucial.

Conclusion:

Selling property isn’t just about finding a buyer and signing papers — it’s also about timing, planning, and calculating your tax smartly.

Section 112’s rules for Taxation on sale of immovable property look simple on the surface (“just 20% or 12.5% tax”), but as we’ve seen, the relief provisions, indexation, and exemptions make it a lot more nuanced.

That’s exactly why we built the Capital Gain Calculator — it handles:

- Date-based rate changes (pre/post 23 July 2024)

- Relief eligibility checks and calculations

- Indexation Applicability

- Exemptions (Sections 54, 54F, 54EC)

- Professional Report Export

- And even short-term scenarios

If you’d rather not navigate the tax maze yourself, we can help you plan your sale and minimise tax legally.

Whether it’s a simple flat sale or a multi-crore land deal, we’ll make sure you know exactly how much tax you’ll pay — and how to reduce it.

Download the Capital Gain Calculator below: