This article is applicable for both FY 2024–25 (AY 2025–26) and FY 2025–26 (AY 2026–27), as the rules under Section 6 remain unchanged.

Before you even open the income tax portal, download Form 16, or pick between Old and New tax regime, you need to answer one very simple but powerful question:

“What is my residential status under income tax law?”

Resident? → Your global income may be taxed

Non-resident? → Only income earned or received in India is taxed

This isn’t just a background detail.

Your residential status decides what part of your income is taxable in India.

In short, where you physically stay can shape how much you financially pay.

Let’s break it down clearly — so that you start your ITR filing journey with income tax clarity.

Residential Status under Income Tax and What They Mean

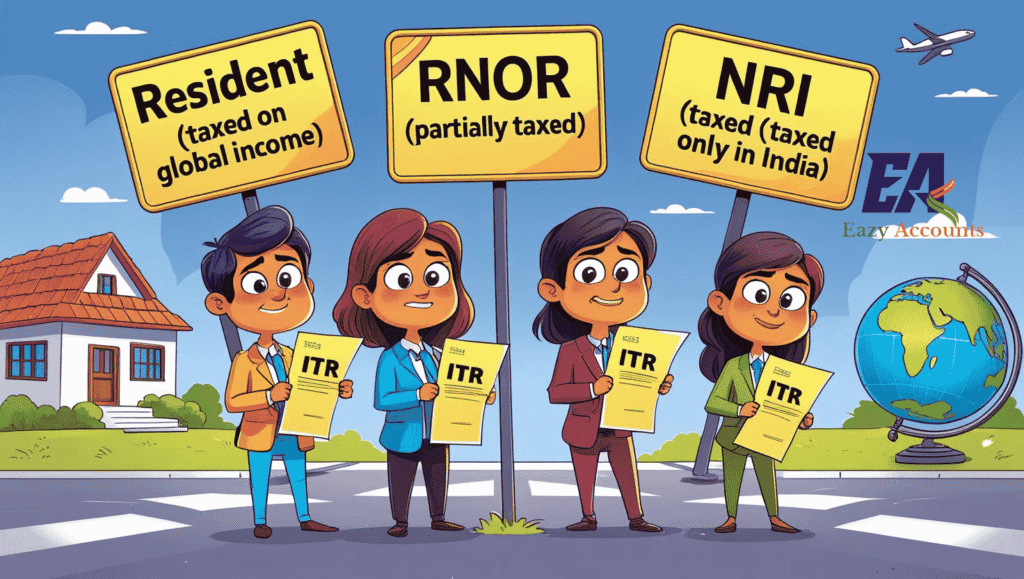

Under the Income Tax Act, there are three possible residential statuses:

- Resident and Ordinarily Resident (ROR)

- Resident but Not Ordinarily Resident (RNOR)

- Non-Resident (NR)

Each category has a different tax scope, which affects what income you need to report — and pay tax on — in your ITR.

Here’s a simple breakdown:

| Status | What’s Taxable in India |

|---|---|

| Resident & Ordinarily Resident (ROR) | Global income (India + abroad) |

| Resident but Not Ordinarily Resident (RNOR) | Income earned or received in India + income from business controlled in India |

| Non-Resident (NR) | Only Indian-sourced income (earned or received in India) |

Resident: Who Qualifies and How It’s Decided

To be called a Resident, you don’t need to own a house in India or hold an Aadhaar card. All that matters is how many days you were physically present in India.

Here’s how it works:

You are a Resident if…

You meet any one of these two conditions during the Financial Year:

| Condition | What it means |

|---|---|

| 1. You were in India for 182 days or more | That’s around 6 months — simplest route to being Resident |

| 2. You were in India for 60 days or more during the year AND 365 days or more in the last 4 years | This test is for people who keep going abroad often |

But Wait: For Some People, the 60-Day Rule is not available

Yes, the Income Tax Act gives relaxations to certain individuals – which means they cannot use the 60-day shortcut to become Resident.

Instead, they must have stayed in India for 182 days or more — no exceptions.

Who Cannot Use the 60-Day Rule?

| Person Type | Why 60-Day Rule is Not Allowed | Minimum Stay Required to Become Resident |

|---|---|---|

| An Indian citizen leaving India for a job or as ship crew | Treated as going abroad permanently | 182 days |

| An Indian citizen or PIO visiting India, and Indian income ≤ ₹15 lakh | Considered short visit, not return | 182 days |

| An Indian citizen or PIO visiting India, and Indian income > ₹15 lakh | Partially allowed — modified rule applies | 120 days (not 60) |

RNOR — The “Halfway Resident” with Special Tax Benefits

Not all Residents are taxed the same way. Some are fully taxed on worldwide income. Some, though technically Residents, are given a special status called: RNOR — Resident but Not Ordinarily Resident

You can qualify as RNOR in either of these two ways:

1. Automatic RNOR — When Law Gives It to You

You are automatically RNOR if:

| Situation | Applies When |

|---|---|

| Deemed Resident | You’re an Indian citizen, earned ₹15L+ in India, and are not liable to tax anywhere else |

| Visiting Indian Citizen/PIO | You stayed in India for 120–181 days and earned more than ₹15L (excluding foreign income) |

In both cases, the law directly grants you RNOR status — no history check needed.

2. RNOR by History — For Returning NRIs

You also become RNOR if you meet any one of these:

| Condition | Applies If… |

|---|---|

| You were non-resident in 9 out of the last 10 years | A common case for long-time NRIs |

| You were in India for ≤ 729 days in the last 7 years | Includes people who visited briefly across years |

Examples That Make It Click:

| Name | Situation | RNOR? |

|---|---|---|

| Rohan | Indian citizen in UAE, stayed 130 days in India, earned ₹18L here, not taxed in UAE | Yes (Deemed Resident + Auto RNOR) |

| Sneha | Returned to India after 9 years abroad, stayed 220 days this year | Yes (History-based RNOR) |

| Arjun | Moved back 5 years ago, was NR in 7 of last 10 years | No (now becomes full Resident) |

NRI – The Non-Resident, Taxed Only on Indian Income

If you don’t qualify as a Resident in any way, congratulations — you’re a Non-Resident for income tax purposes.

NRI is not just a fancy label.

It literally decides what income you’re taxed on — and what you’re not.

Who is an NRI?

You are treated as a Non-Resident under Income Tax law if: You do not qualify as a Resident, AND You do not fall under the RNOR category either

In other words:

- You haven’t stayed in India long enough to be a Resident,

- And you’re not caught in the special cases that make you RNOR

Real-Life Scenarios:

| Person | Days in India | Income | Status |

|---|---|---|---|

| Nisha (working in US) | 60 days | ₹12L from US job | NRI — not taxed on US salary |

| Arvind (came for 110 days from Dubai, ₹20L Indian rent) | 110 days | ₹20L (Indian) | Resident (Deemed) → RNOR |

| Priya (visited India for 40 days) | 40 days | ₹5L Indian FD interest | NRI — taxed only on FD interest |

Your entire tax treatment starts from this one question: Are you Resident, RNOR, or Non-Resident?

- It changes what income gets taxed

- It decides whether foreign assets must be reported

- It affects your deductions, exemptions, and paperwork

So before choosing the right ITR Form, section, or tax regime, just ask yourself: Where did you actually live – and for how long?

Because in Indian tax law, Where you stay decides what you pay.

Need Help Figuring Out Your Residential Status?

If you’re still unsure whether you’re Resident, RNOR, or Non-Resident, don’t worry — you’re not alone. With changing laws and confusing exceptions, even seasoned professionals pause to double-check.

We specialize in simplifying income tax matters – especially for self-filers, NRIs, and returning residents. From helping you choose the correct ITR form to planning your tax strategy around your residential status, we’ve got you covered.

Have a query or need personalised advice?

Reach out to us and let’s make tax filing stress-free.