Introduction – When It’s a Mistake, Not a Crime

In GST, not every short payment or wrong ITC claim is a grand conspiracy. Sometimes, it’s just a slip — wrong calculation, missed entry, or a refund that shouldn’t have been processed.

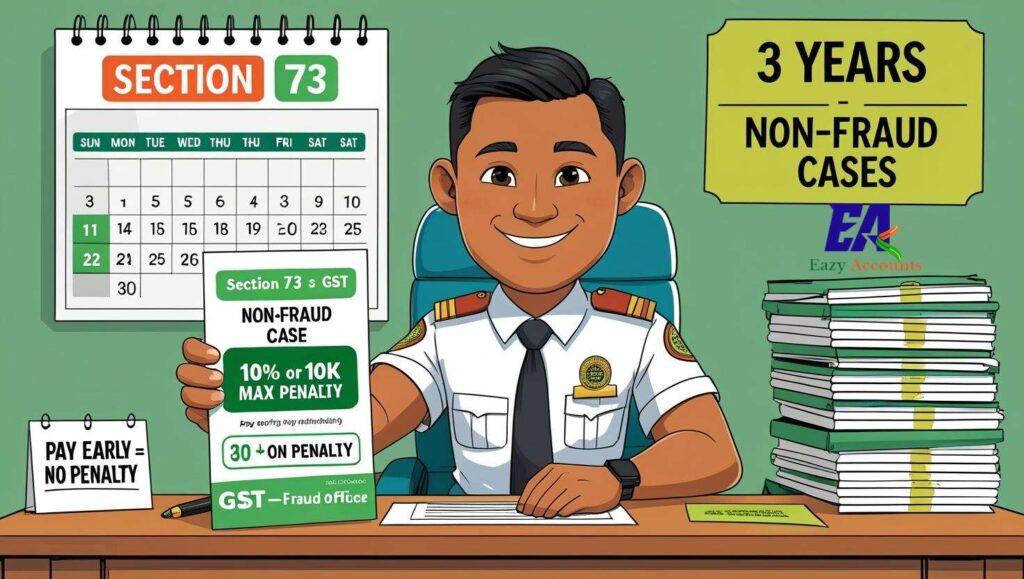

That’s where Section 73 of GST Act steps in. It’s the Essential rule for cases without fraud, wilful misstatement, or suppression. Think of it as the “we believe you didn’t mean it” category — but yes, you still need to pay up (with some interest and maybe a small penalty).

What Section 73 of GST Act Says – In Simple Language

If tax is unpaid, short paid, refunded wrongly, or ITC is wrongly used without fraud, wilful misstatement, or suppression, the GST officer can issue a notice within 3 years from the due date of the annual return.

You can avoid penalties entirely by paying before or soon after the notice. If you delay, a penalty of 10% of the tax or ₹10,000 (whichever is higher) applies.

When It Applies & Timelines

Section 73 of GST Act is triggered when:

- Tax is not paid or short paid,

- Refund is erroneously granted, or

- ITC is wrongly availed or utilised,

…and none of it involves fraud, wilful misstatement, or suppression of facts.

Key timelines:

| Step | Time Limit |

|---|---|

| SCN issue | Within 3 years from the due date of the annual return for that FY (or from the date of erroneous refund) |

| Order issue | SCN must be issued at least 3 months before the order; order within the same 3-year window |

Penalty Rules & Early Payment Benefits

Section 73 of GST Act keeps penalties light — and even waives them entirely if you pay early.

| When You Pay | What You Pay | Penalty |

|---|---|---|

| Before SCN | Tax + Interest | No Penalty |

| Within 30 days of SCN | Tax + Interest | No Penalty |

| After 30 days of SCN but before order | Tax + Interest + 10% of tax or ₹10,000 (whichever is higher) | Full Penalty |

| After Order | Tax + Interest + 10% of tax or ₹10,000 | Full Penalty |

Essential takeaway: Settle before or soon after SCN, and you skip the penalty entirely.

Quick Practical Tip

If you get a notice under Section 73 of GST Act, it means the department believes your case is non-fraud. That’s good news — penalties are light, and you can avoid them entirely by paying early.

But if you get a notice under Section 74 of the GST Act, the department is alleging fraud, wilful misstatement, or suppression — and penalties there can go up to 100% of the tax.

Remember, from FY 2024–25 onwards, Section 73 or Section 74 no longer exists. All such cases now fall under Section 74A of GST Act.

Related Reads: